Unit 4 → Subtopic 4.2

The USMCA’s Influence on Global Trade

The United States-Mexico-Canada Agreement (USMCA), implemented in July 2020, replaced the North American Free Trade Agreement (NAFTA) and introduced new provisions aimed at modernizing North American trade, strengthening labor protections, and addressing digital commerce and environmental concerns. Covering a $1.5 trillion regional trade network, the USMCA has had far-reaching implications for supply chains, manufacturing industries, and investment flows across North America. While the agreement has enhanced trade stability and boosted economic ties between the United States, Canada, and Mexico, it has also reshaped global trade patterns, altered competitive dynamics, and created regulatory challenges for multinational corporations.

Since its enactment, USMCA has facilitated growth in North American trade, which reached $1.6 trillion in 2023, an increase of 6.5% from pre-pandemic levels. It has also expanded labor rights in Mexico, revised automobile industry regulations, and addressed concerns over intellectual property protections and digital trade. However, tensions remain over issues such as country-of-origin rules, environmental standards, and labor enforcement mechanisms, which continue to impact trade flows and investment decisions.

As global trade shifts in response to geopolitical tensions, supply chain disruptions, and the rise of protectionist policies, the USMCA has played a critical role in reshaping North America's economic integration. This case study explores the agreement’s impact on trade relations, its benefits and challenges, and its broader implications for global economic trends.

The Impact of USMCA on North American Trade and Supply Chains

The USMCA has strengthened trade flows between the three member nations, with Mexico surpassing China as the United States’ largest trading partner in 2023, largely due to supply chain shifts and trade rebalancing efforts. The agreement has helped reduce trade barriers and improve market access, particularly in agriculture, manufacturing, and digital commerce.

One of the most significant provisions of the USMCA is the change in automotive industry rules, which require 75% of a vehicle’s parts to be manufactured in North America (up from 62.5% under NAFTA) to qualify for tariff-free trade. This rule aims to increase domestic production, create more jobs in the United States and Canada, and reduce dependency on Asian supply chains. As a result, automobile manufacturing in Mexico has surged, with Mexico’s vehicle exports to the US rising by 18% in 2023, while investment in North American auto production has increased by over $40 billion since the agreement’s implementation.

Additionally, the USMCA introduced stronger labor provisions, particularly in Mexico, requiring that at least 40% of auto workers earn a minimum of $16 per hour to qualify for duty-free vehicle exports. This provision was designed to prevent wage suppression in the US and Canada while improving Mexican labor conditions. Since the agreement’s implementation, Mexican wages in manufacturing have risen by 12%, and over 5,000 new labor inspections have been conducted to enforce labor laws.

In the agricultural sector, the USMCA has preserved tariff-free trade for most agricultural goods, allowing Canadian and Mexican farmers to maintain strong access to the US market, which is worth over $65 billion annually. However, disputes have arisen over dairy trade regulations, with US dairy exports to Canada increasing by 20% due to Canada’s commitment to open more of its dairy market to US producers. Canadian farmers, in response, have criticized the agreement for disrupting local dairy industries and lowering domestic prices.

The agreement has also introduced new digital trade rules, ensuring cross-border data flows, intellectual property protections, and e-commerce growth. With North America’s digital economy surpassing $1 trillion in 2023, these rules have been essential in facilitating online trade, protecting digital content, and ensuring cybersecurity standards.

Challenges and Controversies Surrounding USMCA Implementation

Despite its benefits, the USMCA has sparked trade tensions and regulatory challenges that continue to shape economic relations between the three member nations. One of the most contentious issues is country-of-origin rules, particularly in the automotive sector, where manufacturers have faced higher costs due to stricter regulations. Some automakers have argued that the new rules increase production costs and reduce flexibility in global supply chains, as sourcing parts from Asia or Europe has become more expensive.

Another significant challenge is labor rights enforcement in Mexico, with US labor unions and officials raising concerns over whether Mexico is fully complying with new labor protections. While Mexico has implemented labor reforms, improved wage standards, and increased inspections, critics argue that enforcement remains inconsistent, particularly in rural manufacturing zones.

Environmental disputes have also emerged, particularly between the US and Canada, regarding fossil fuel policies and emissions regulations. Canada has accused the US of unfairly subsidizing domestic energy projects, while the US has challenged Canada’s environmental policies on oil and gas production, arguing that they violate free trade principles. These disputes highlight the ongoing difficulty of aligning trade policies with environmental commitments.

Another controversial aspect of the agreement is Mexico’s trade policies regarding energy sector reforms, which have led to investor disputes with US and Canadian firms. The Mexican government has prioritized state control over energy production, limiting private investment in renewable energy and fossil fuel projects. This has resulted in multiple trade complaints under USMCA’s dispute resolution mechanisms, with foreign investors arguing that Mexico’s policies unfairly disadvantage foreign energy companies.

USMCA’s Role in the Global Trade Landscape

Beyond North America, the USMCA has significant global implications, influencing supply chain restructuring, trade negotiations, and investment flows worldwide. The agreement has encouraged companies to shift production from China to North America, particularly in automobile manufacturing, electronics, and machinery, as firms seek to reduce exposure to US-China trade tensions and mitigate geopolitical risks.

The nearshoring trend, where companies move production closer to the US, has accelerated since the USMCA’s implementation. Mexico, in particular, has benefited from nearshoring investments, with foreign direct investment in Mexican manufacturing increasing by 22% since 2021, as companies diversify their supply chains away from Asia.

Additionally, the USMCA’s digital trade provisions have set a precedent for future trade agreements, as countries worldwide grapple with data privacy, cybersecurity, and intellectual property protection. Other trade blocs, including the EU and ASEAN, have looked to the USMCA as a model for integrating digital trade rules into new trade agreements.

However, as global trade shifts toward protectionist policies, rising tariffs, and economic nationalism, the long-term success of the USMCA will depend on continued regulatory cooperation, investment in infrastructure, and balancing national interests with regional economic integration.

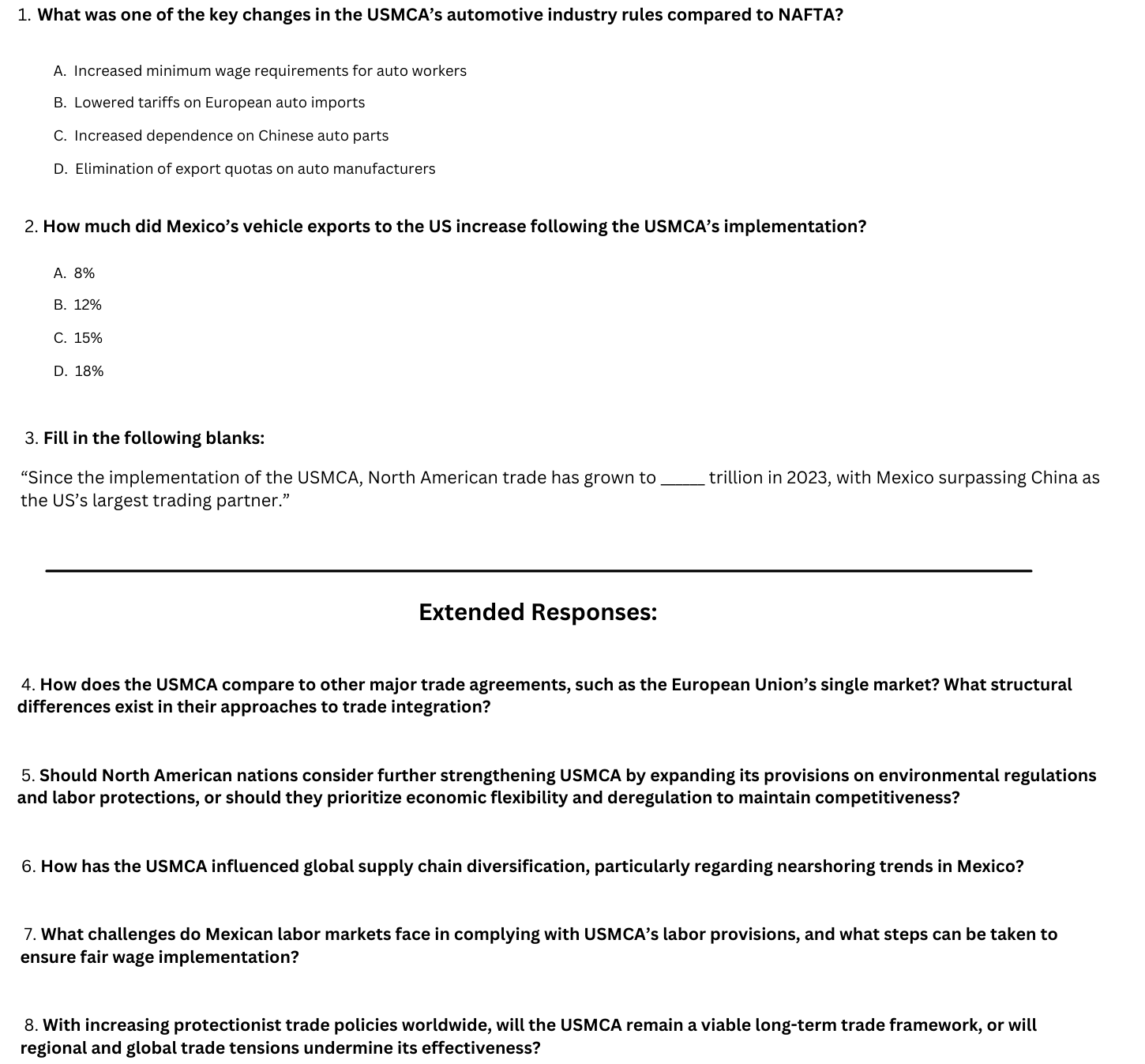

Comprehension Questions:

Going a Step Further…

Should the USMCA be further expanded to include stronger environmental and labor protections, or should it focus on increasing economic flexibility to maintain North America’s global trade competitiveness? Discuss the economic and regulatory trade-offs of both approaches.

Total Points: __ /28